tennessee inheritance tax laws

IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. From Fisher Investments 40 years managing money and helping thousands of families.

Prior to 2016 Tennessee imposed a separate inheritance tax and had an exemption from that tax that was less than the federal estate tax exemption.

. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. Application For Tennessee Inheritance Tax Waiver RV-F1400301 Step 2. An inheritance tax a capital gains tax and an estate tax.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. Click here for guidance on how to calculate the apportioned amount of the exemption that. The only situation where this tax might.

Therefore it is critically important for each individual to have a will especially if there is a family dynamic that makes you. As of January 1 2016 Tennessees inheritance tax is fully repealed. However it applies only to the estate physically located and transferred within the state between Tennessee residents.

The estate of a non-resident of Tennessee would not receive the full exemption. Very few people now have to pay these taxes. Hire a good estate planning attorney.

Ad Form TN DOR INH 302 More Fillable Forms Register and Subscribe Today. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. Tennessees inheritance tax known in most states as an estate tax phased out permanently at the start of 2016 which means for anyone who passed away on or after January 1 2016 no estate tax will be due to the state of Tennessee.

The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. State Inheritance Tax Return Long Form Please note that schedules A through O listed under other forms must be attached to the completed long form. There three different ways to classify property for the sake of inheritance.

The inheritance tax is paid out of the estate by the executor. No tax for decedents dying in 2016 and thereafter. It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be.

That amount increases by 90000 to 5430000 in 2015. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. Tennessees tax exemption schedule is as follows.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Final individual federal and state income tax returns. The inheritance tax is different from the estate tax.

For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000. Although Tennessee is phasing out its inheritance tax the federal government imposes an inheritance tax only for larger estates. The net estate less the applicable exemption see the Exemption page is taxed at the following rates.

The inheritance tax is levied on an estate when a person passes away. Additionally the Tennessee inheritance tax is now abolished in Tennessee for any person who dies in 2016 or later. Question one asks whether a representative for the.

Next 240000 - 440000. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. How to avoid probate in Tennessee.

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. It simply does not exist any longer. In January of 2016 Tennessee repealed its inheritance tax to encourage residents to continue to live and retire within the state.

The federal estate tax exemption is 5450000 for 2016 and is indexed for inflation. Those who handle your estate following your death though do have some other tax returns to take care of such as. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

Give the complete name of the person whose estate is in question and the county in which they lived as well their date of death and Social Security number. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Application For Tennessee Inheritance Tax Waiver RV-F1400301 Step 1. For example the neighboring state of Kentucky does have an inheritance tax. States which follow common law policies dont.

Add a transfer on death deed to any real estate you own. Tennessee is an inheritance tax and estate tax-free state. Instructions for State Inheritance Tax Return.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Our Nashville based. Download Or Email TN DOR 302 More Fillable Forms Register and Subscribe Now.

Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. Adopted children receive an equal share of the deceaseds estate with their biological children. If you have questions regarding a Tennessee probate matter contact The Higgins Firm.

Tennessee requires that children who inherit an estate under the Tennessee intestacy laws be the decedents legal descendants. Next 40000 - 240000. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016.

Open bank accounts and designate heirs as beneficiaries of the accounts. 31-2-104 b 4 2014 If no surviving heirs in the grandparents line then the property escheats to the State of Tennessee which means the State inherits your property. Technically Tennessee residents dont have to pay the inheritance tax.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. The good news is that Tennessee is not one of those six states. Tennessee does not have an inheritance tax either.

Year Amount Exempted. Due by Tax Day of the year following. The federal exemption amount in 2014 is 5340000.

Create a revocable living trust. For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. This is a type of inheritance law where each spouse automatically owns half of what they each obtained while married.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. Please DO NOT file for decedents with dates of death in 2016. Federal estatetrust income tax return.

This change is the result of a law passed by the Tennessee legislature in 2012 that gradually increased. You could potentially be liable for three types of taxes if youve received a bequest from a friend or relative who has died. Follow me on Twitter at jasonalee for updates from the Tennessee Wills and Estates blog.

The inheritance tax applies to money and assets after distribution to a persons heirs. IT-17 - Inheritance Tax -. Tennessee Inheritance and Gift Tax.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. The inheritance tax is no longer imposed after December 31 2015. An inheritance tax is a tax on the property you receive from the decedent.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Each due by tax day of the year following the individuals death. IT-16 - No Beneficiary Classes for Inheritance Tax.

However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. Assets in excess of the federal exemption are. So there are no separate considerations needed to handle any Tennessee inheritance tax.

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is There A Federal Inheritance Tax Legalzoom Com

State Estate And Inheritance Taxes Itep

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Living Trusts Revocable Trust Trust Words Living Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

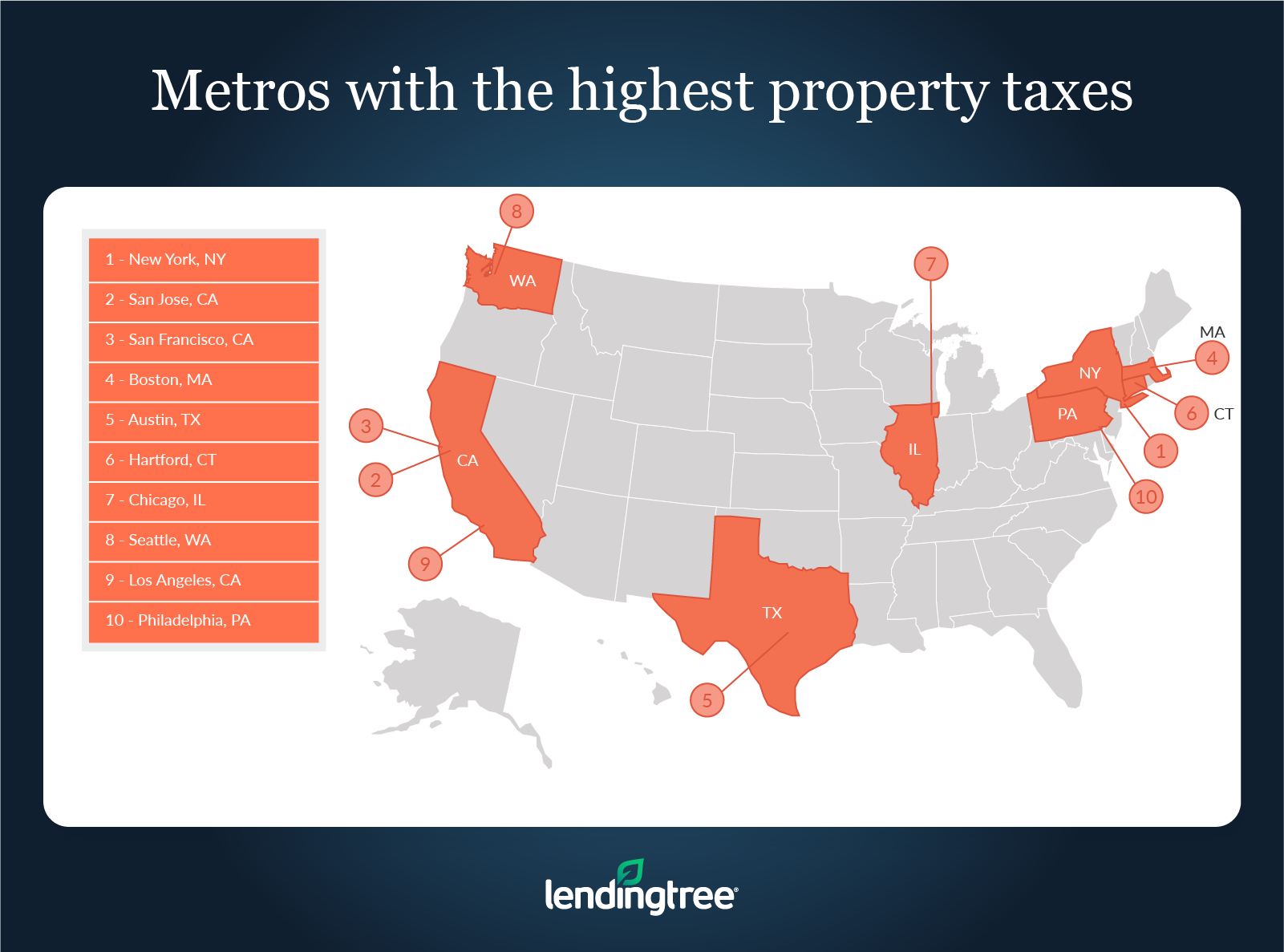

Where People Pay Lowest Highest Property Taxes Lendingtree

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where People Pay Lowest Highest Property Taxes Lendingtree

Tax Burden By State 2022 State And Local Taxes Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

How Do State Estate And Inheritance Taxes Work Tax Policy Center